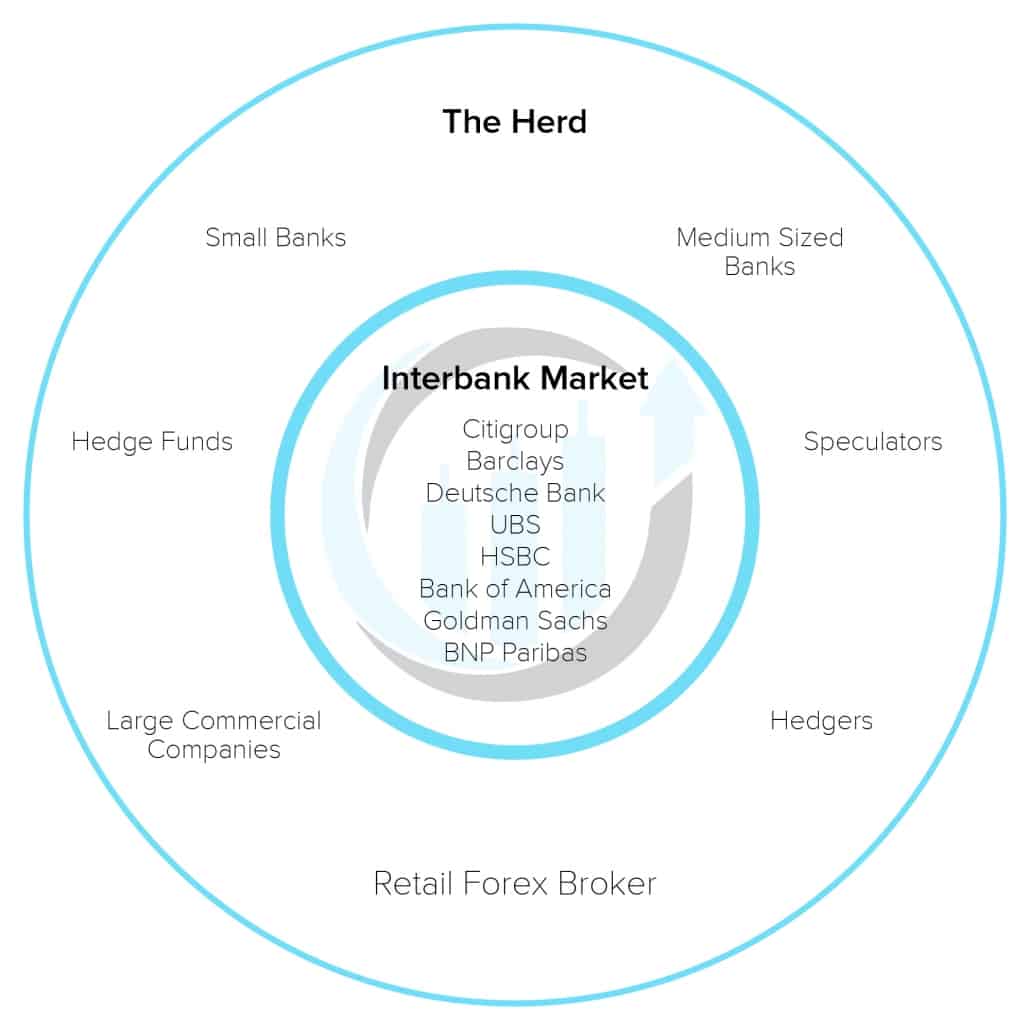

The Interbank Market

The Interbank Market is the currency market where the really big and smart money is changing hands. It is the top-level foreign exchange market where the biggest participants in the game such as JP Morgan, Deutsche Bank, Barclays, Citigroup, HSBC, Goldman Sachs and other major banks exchange different currencies. They are the Smart Money and this is their game, we’re just here to play it.

The Interbank market will provide the Bid and Ask prices for each currency pair at any given time the currency is bought or sold (even if there are no buyers or sellers), acting as Market Makers. These big banks are responsible for approx. 70% of the daily volume on the Foreign exchange market.

Retail Market (The Herd)

On the other side of the interbank market, you have the retail market, and the retail traders. If you are reading this, you are most likely part of this group. We are market participants too, but we’re the little guys.

We are also small sized financial institutions like banks, hedge funds, Forex brokers, day traders, and speculators. Anything outside of the interbank market can be considered the retail market, or the herd. The interbank market will try to match all buy and sell orders of the herd, however in reality there is always an imbalance of buyers and sellers. With this imbalance, the interbank market is used so each buy and sell order has a counterparty to get executed, acting as a liquidity provider.

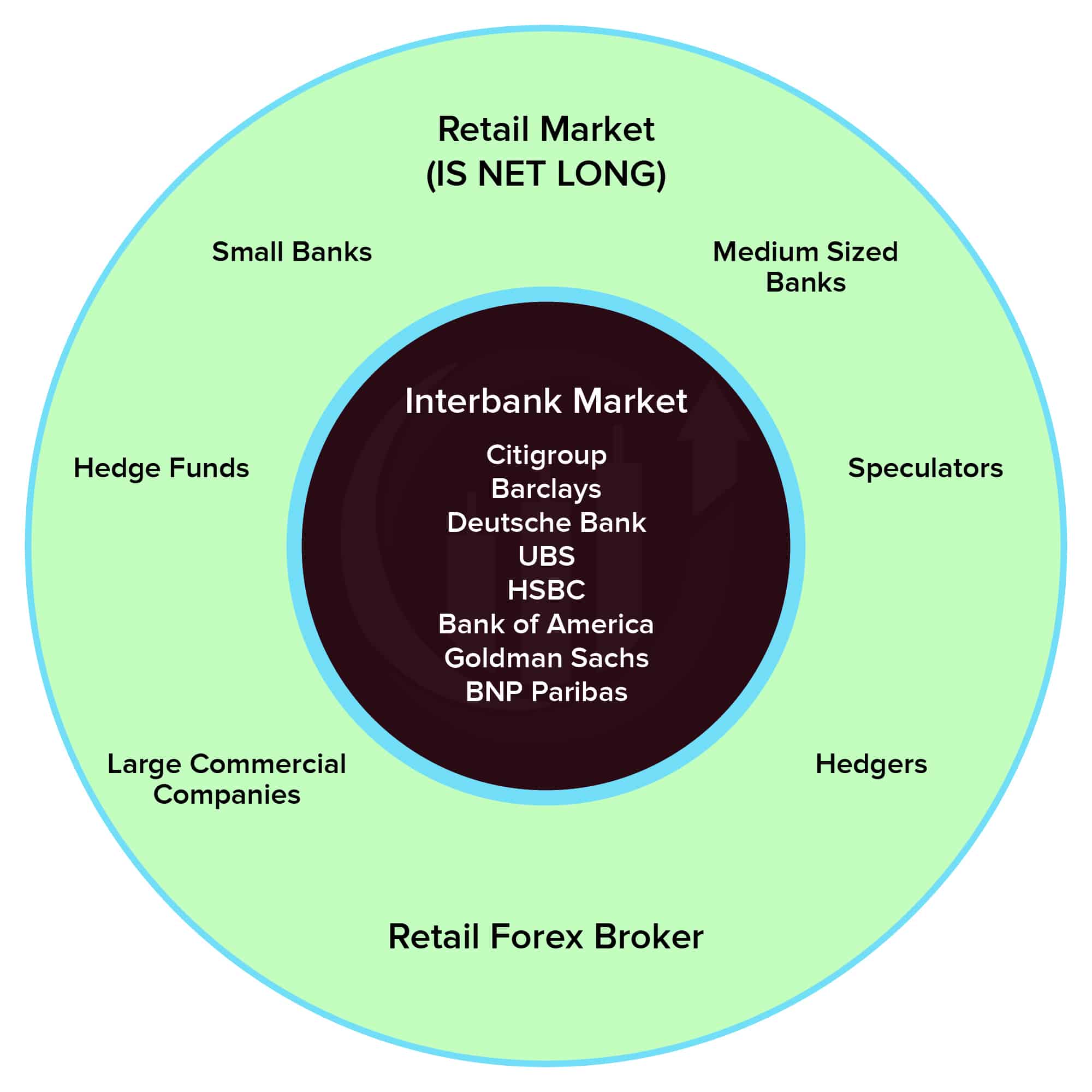

When Retail Market is Net Long then the Interbank Market (the Smart Money) is Net Short in the FX Markets

When Retail Market is Net Short then the Interbank Market (the Smart Money) is Net Long in the FX Markets

The Relationship between the Smart Money and the Retail Market

When the retail market is net long, the smart money is net short and vice-versa. When the retail market is net short the smart money will be net long.

As a day trader in the Retail Market, we are trading AGAINST the major banks (AKA Smart Money)

Now do you see why retail traders are at such a disadvantage? Now do you see why they call us “Dumb Money”? Now do you understand why learning how Smart Money operates and how institutional trading strategies will further your success?

If so, you might want to check out our Smart Money Mentorship where we teach beginner to advanced concepts of Institutional Forex trading.

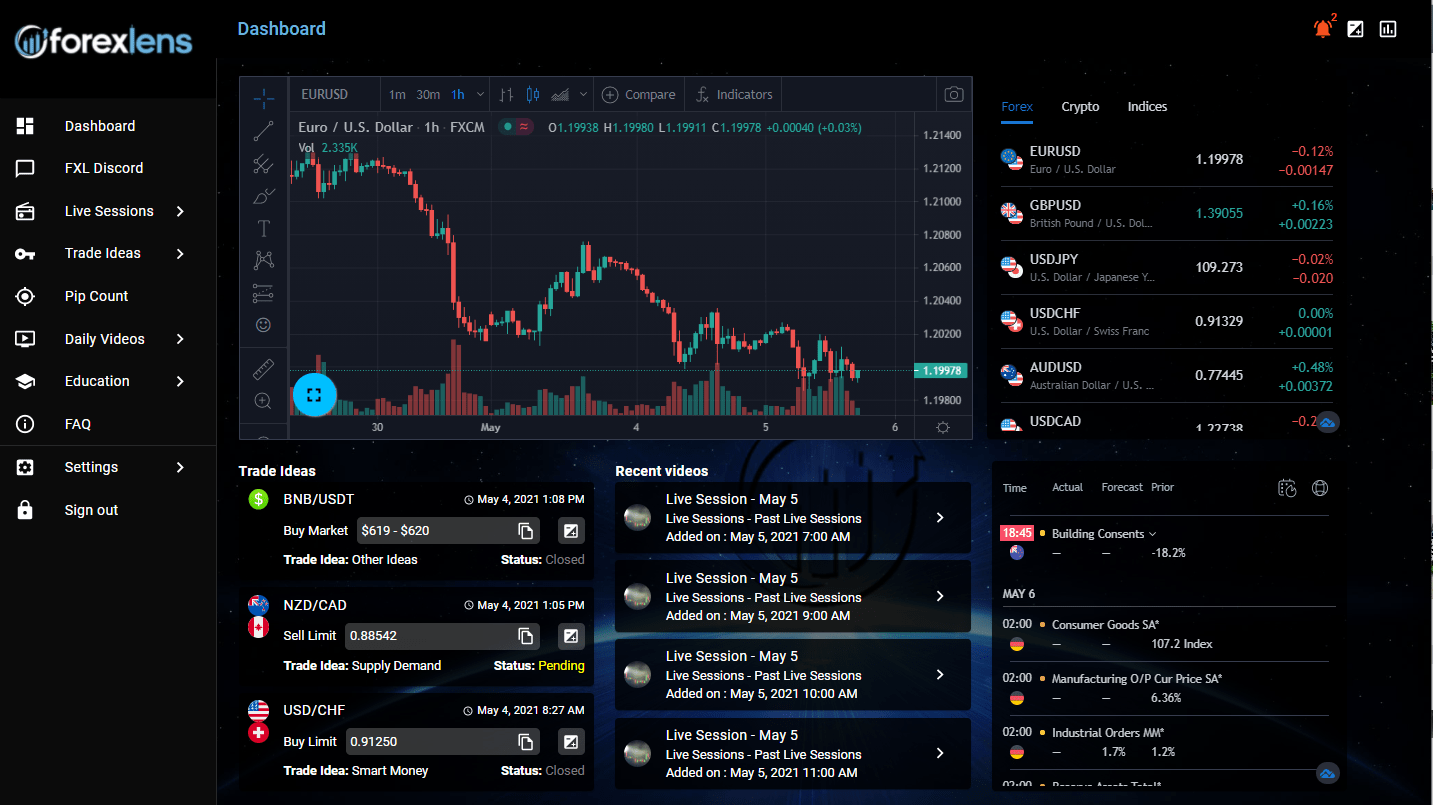

Get the latest Smart Money updates inside our trading portal

Multiple live sessions each day going over the markets with trade(s) of the day.

Trade ideas shared with Entry price, Stop Loss, and Take Profit targets with chart work and timeline.

Daily short video recaps of the live sessions in case you missed it or don’t have time to watch full sessions.

Over 100+ videos of content organized to help you learn our trading methodologies.